Business & Management

Take Profit First Series

Take Profit First as A State of Mind

Listen:

0:00/1:34

The healthiest way to bring any business to success is to keep it profitable. It sounds obvious, doesn't it? But some companies tend to completely forget about this goal. It is especially common for small and medium-sized businesses. To be honest, I have walked that path myself before. It often happens due to a strong desire to show the world how good you are at what you do. In the worst cases, it might happen because of a "pick me" mindset. And this path leads to sacrifices, tough choices, and loss of opportunities. Good for others, not so good for yourself and your team.

Rule #1: Each Market Activity Must Bring Profit

This idea should become the cornerstone of each business decision you make. But don’t get me wrong—I'm not saying we should turn everything good into profit. It's about separating the concepts. Business is a tool to make money, while chasing your dreams or having a good time is where you spend it. People grasp this idea in their unique way. But it seems that mastering each side before mixing them is a good way to start.

It might surprise you how often talented people forget about the money part. It's more important to focus on what matters right now, isn't it? A new challenge awaits! That's perfect—that's why we live in a better world. Wait for a sec. But we need a solution to capture profit. It should be simple, yet efficient.

Rule #2: Take Profit First

If you try to look for advice, you hardly ever find anything viable. At least for me, that has been the case for some time. They say the best way to find a new idea is to explore where two different fields merge. And I've found some inspiration in personal finance. Have you heard about Pay Yourself First¹? It's a very popular and simple idea that helps establish a way to start making savings. To me, it sounds like a way to make a profit out of income. Or am I only dreaming?

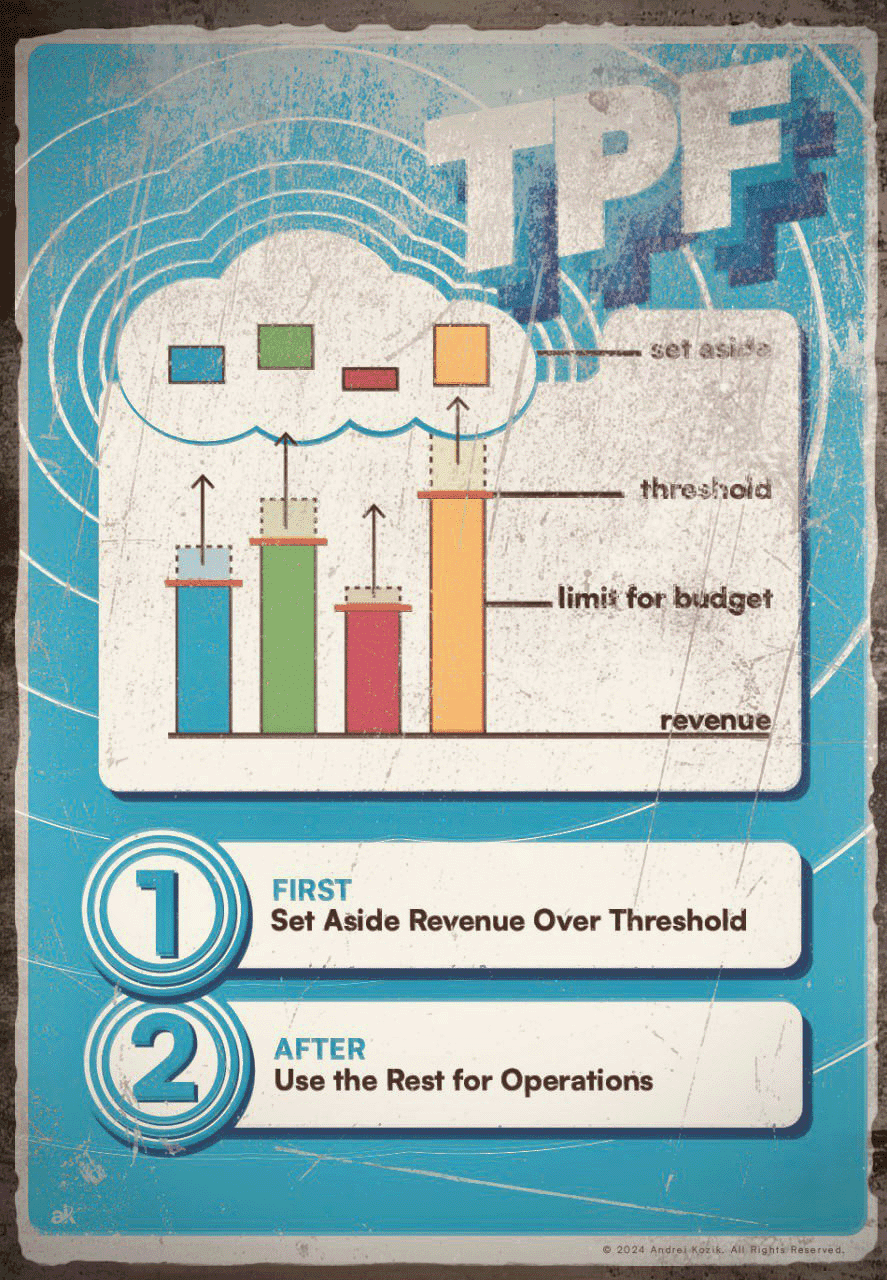

Listen, here is the plan. Let's name it Take Profit First to make it less related to personal finance:

1. Set Goals

Why do you need goals here? Easy. To get a rough estimate of how much money you need to earn. The simpler and more straightforward the goals are, the better. Don't worry. It shouldn't be the ultimate goal or mission of your business. It is a simple financial goal.

Let's say your sales each quarter are 500k (choose your own amount and currency). And you want to build a new department and expand your offering. To find people, onboard them, and get all the required equipment, you need around 200k. That's a goal. And based on your sales, it will take some time to achieve.

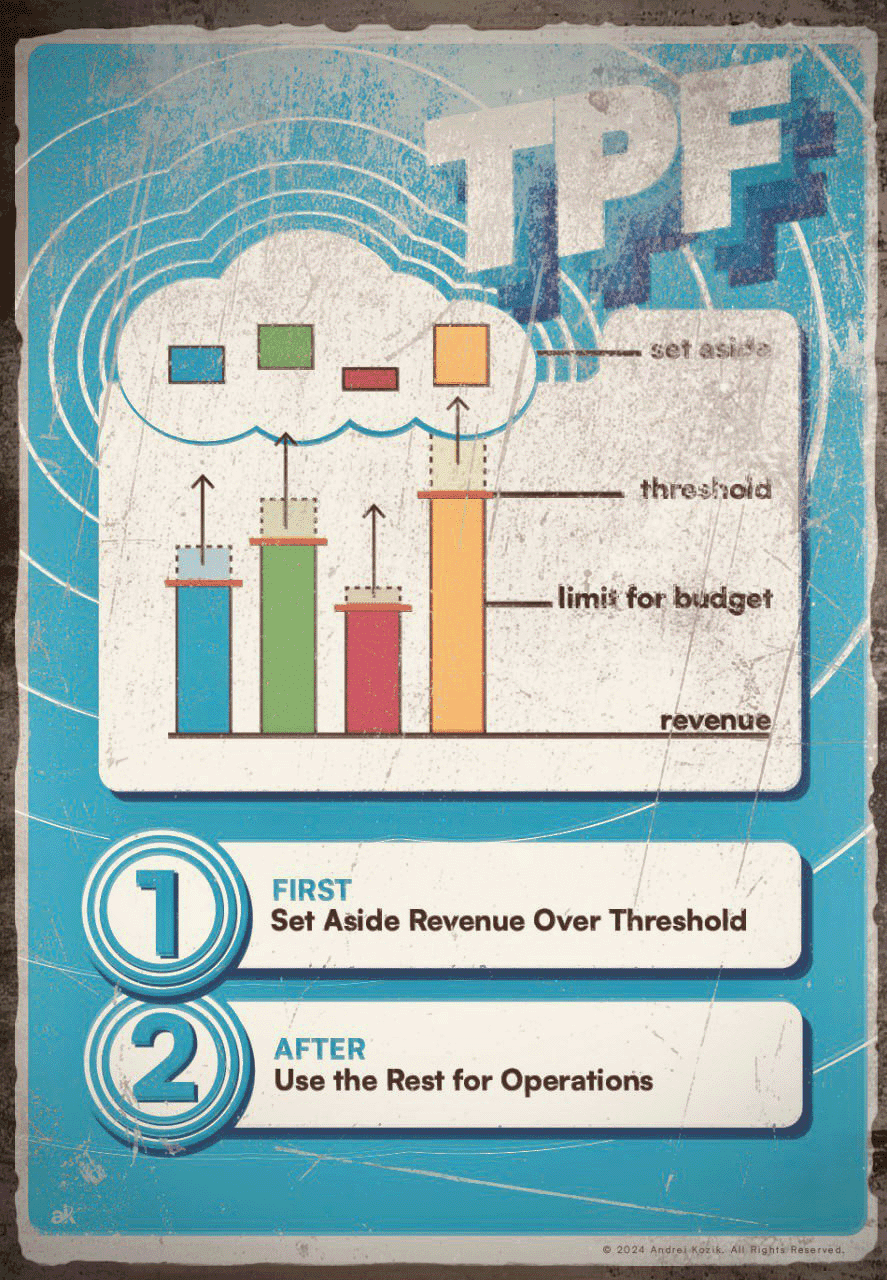

2. Define a Threshold

Now you can go the usual way — do your best until you earn 200k to set aside, or make it different. Let's say you want to achieve your goal in 12 months. That means each quarter you want to set 50k aside. It is 10% of your sales. (You use percentages to be more flexible.)

That's how we set the threshold. It is a relative amount we save from sales. Why is this important? When you know your threshold, you can plan your costs, capped by what remains in advance. You are planning what to do, not waiting for the end-of-quarter report to see how much money to set aside.

Such a simple step changes the basis of your planning. You're limiting your costs without any extra effort. And that works. It works with the human mind. The same way Pay Yourself First works in personal finance.

(You can try to get a loan... let's get back to it in a sec)

3. Set Aside

Here is an important trick. When setting the threshold amount aside, make sure you set it aside. I mean, transfer it to another account; hide it from the budget, but don't forget to pay the taxes when you have to.

In personal finance, you put the saved money into a separate savings account. Most banks provide you with enough tools to automate this step.

This solves three issues:

it hides the money from your current account so you have less temptation to spend it;

it helps to get fewer negative effects from inflation;

it ensures you will not forget or postpone the transfer.

It might not be that easy with corporate accounts. But you got the idea. I trust you or your finance team to find the best way to make the money work and reach your goals.

Loans

A good way to get money fast. Also, it will make you enjoy all the benefits of the Take Profit First approach. You will have to set money "aside, back to the bank" whether you wish to or not.

Pros:

If you're eligible, you get the funding now and may achieve your business results faster. It might be crucial for overcrowded markets.

You know how much money you need to set aside (your bank will tell you), and you need to plan with this idea in mind.

Cons:

You lose control over the money you "set aside" and have less freedom to react to business realities. Don't tell me you don't want a plan B to cover cash gaps.

You can't change your mind over time. And you can't redistribute the resources at any time you want. So, if time to market is not that important to your case, why would you ever want to make things hard?

Think of the Take Profit First as borrowing a loan from yourself with the option to repay whenever you want. The key trade-off is the moment you receive the full amount.

Make the Rules Rule

Take Profit First is an adaptation of the Pay Yourself First approach for businesses. The core idea is exactly the same — you capture value before you spend money on value creation. It helps you be more realistic about your business and ambitions. It allows you to avoid overspending while growing your venture. You may adapt your goals at any time. You may change the threshold whenever circumstances make you do so. And it costs nothing to try.

To enhance the effect, you may make your company processes obey the same rules. Review the result and adjust to your reality. Take it to the pricing strategy, project estimates, and cost management. I use this approach at the project management level, and it reveals a lot. But that's another story for another day.

What are your financial goals? How do you plan to reach them? What threshold might work well for your business? Ask yourself these questions to start modeling the way to use Take Profit First for your own benefit.

—

¹ Pay Yourself First is the idea described in the book “The Richest Man in Babylon” by George S. Clason, 1926.

The healthiest way to bring any business to success is to keep it profitable. It sounds obvious, doesn't it? But some companies tend to completely forget about this goal. It is especially common for small and medium-sized businesses. To be honest, I have walked that path myself before. It often happens due to a strong desire to show the world how good you are at what you do. In the worst cases, it might happen because of a "pick me" mindset. And this path leads to sacrifices, tough choices, and loss of opportunities. Good for others, not so good for yourself and your team.

Rule #1: Each Market Activity Must Bring Profit

This idea should become the cornerstone of each business decision you make. But don’t get me wrong—I'm not saying we should turn everything good into profit. It's about separating the concepts. Business is a tool to make money, while chasing your dreams or having a good time is where you spend it. People grasp this idea in their unique way. But it seems that mastering each side before mixing them is a good way to start.

It might surprise you how often talented people forget about the money part. It's more important to focus on what matters right now, isn't it? A new challenge awaits! That's perfect—that's why we live in a better world. Wait for a sec. But we need a solution to capture profit. It should be simple, yet efficient.

Rule #2: Take Profit First

If you try to look for advice, you hardly ever find anything viable. At least for me, that has been the case for some time. They say the best way to find a new idea is to explore where two different fields merge. And I've found some inspiration in personal finance. Have you heard about Pay Yourself First¹? It's a very popular and simple idea that helps establish a way to start making savings. To me, it sounds like a way to make a profit out of income. Or am I only dreaming?

Listen, here is the plan. Let's name it Take Profit First to make it less related to personal finance:

1. Set Goals

Why do you need goals here? Easy. To get a rough estimate of how much money you need to earn. The simpler and more straightforward the goals are, the better. Don't worry. It shouldn't be the ultimate goal or mission of your business. It is a simple financial goal.

Let's say your sales each quarter are 500k (choose your own amount and currency). And you want to build a new department and expand your offering. To find people, onboard them, and get all the required equipment, you need around 200k. That's a goal. And based on your sales, it will take some time to achieve.

2. Define a Threshold

Now you can go the usual way — do your best until you earn 200k to set aside, or make it different. Let's say you want to achieve your goal in 12 months. That means each quarter you want to set 50k aside. It is 10% of your sales. (You use percentages to be more flexible.)

That's how we set the threshold. It is a relative amount we save from sales. Why is this important? When you know your threshold, you can plan your costs, capped by what remains in advance. You are planning what to do, not waiting for the end-of-quarter report to see how much money to set aside.

Such a simple step changes the basis of your planning. You're limiting your costs without any extra effort. And that works. It works with the human mind. The same way Pay Yourself First works in personal finance.

(You can try to get a loan... let's get back to it in a sec)

3. Set Aside

Here is an important trick. When setting the threshold amount aside, make sure you set it aside. I mean, transfer it to another account; hide it from the budget, but don't forget to pay the taxes when you have to.

In personal finance, you put the saved money into a separate savings account. Most banks provide you with enough tools to automate this step.

This solves three issues:

it hides the money from your current account so you have less temptation to spend it;

it helps to get fewer negative effects from inflation;

it ensures you will not forget or postpone the transfer.

It might not be that easy with corporate accounts. But you got the idea. I trust you or your finance team to find the best way to make the money work and reach your goals.

Loans

A good way to get money fast. Also, it will make you enjoy all the benefits of the Take Profit First approach. You will have to set money "aside, back to the bank" whether you wish to or not.

Pros:

If you're eligible, you get the funding now and may achieve your business results faster. It might be crucial for overcrowded markets.

You know how much money you need to set aside (your bank will tell you), and you need to plan with this idea in mind.

Cons:

You lose control over the money you "set aside" and have less freedom to react to business realities. Don't tell me you don't want a plan B to cover cash gaps.

You can't change your mind over time. And you can't redistribute the resources at any time you want. So, if time to market is not that important to your case, why would you ever want to make things hard?

Think of the Take Profit First as borrowing a loan from yourself with the option to repay whenever you want. The key trade-off is the moment you receive the full amount.

Make the Rules Rule

Take Profit First is an adaptation of the Pay Yourself First approach for businesses. The core idea is exactly the same — you capture value before you spend money on value creation. It helps you be more realistic about your business and ambitions. It allows you to avoid overspending while growing your venture. You may adapt your goals at any time. You may change the threshold whenever circumstances make you do so. And it costs nothing to try.

To enhance the effect, you may make your company processes obey the same rules. Review the result and adjust to your reality. Take it to the pricing strategy, project estimates, and cost management. I use this approach at the project management level, and it reveals a lot. But that's another story for another day.

What are your financial goals? How do you plan to reach them? What threshold might work well for your business? Ask yourself these questions to start modeling the way to use Take Profit First for your own benefit.

—

¹ Pay Yourself First is the idea described in the book “The Richest Man in Babylon” by George S. Clason, 1926.